2023

MASSACHUSETTS CLEAN ENERGY INDUSTRY REPORT

2023

MASSACHUSETTS CLEAN ENERGY INDUSTRY REPORT

CONTENTS

About MassCEC

Note From The CEO

Industry Highlights

Economic Contribution

Massachusetts Is A Leader

Massachusetts Climate Goals

Clean Energy Jobs and Businesses

Gross State Product

Clean Energy Talent

Workforce Needs Assessment

Clean Energy Investments and Innovation

Regional Analysis

Methodology

Glossary

ABOUT MASSCEC

SINCE 2010 MASSCEC HAS

ABOUT MASSCEC

MassCEC is governed by a Board of Directors, which is chaired by Massachusetts Energy and Environmental Affairs Secretary Rebecca Tepper.

AREAS OF FOCUS

read more…

NOTE FROM THE CEO

Emily Reichert

The Massachusetts Clean Energy Center is pleased to present our 2023 Clean Energy Industry Report. This report provides an overview of the clean energy industry in Massachusetts, demonstrates the tangible results of focused leadership in both the public and private sectors, and shares stories of MassCEC’s successful contributions to growing the industry.

This past year, the clean energy field experienced a dynamic period of powerful activity. Since taking office in January, the Healey-Driscoll Administration has sent a clear signal that Massachusetts is ready to lead on climate. Supporting expansion for equity-led workforce growth, pioneering creative climate financing solutions, bolstering budgetary support for energy and environmental activities, and striking a bold stance on offshore wind, Governor Healey and other leaders in state government are empowering Massachusetts to reach its climate targets.

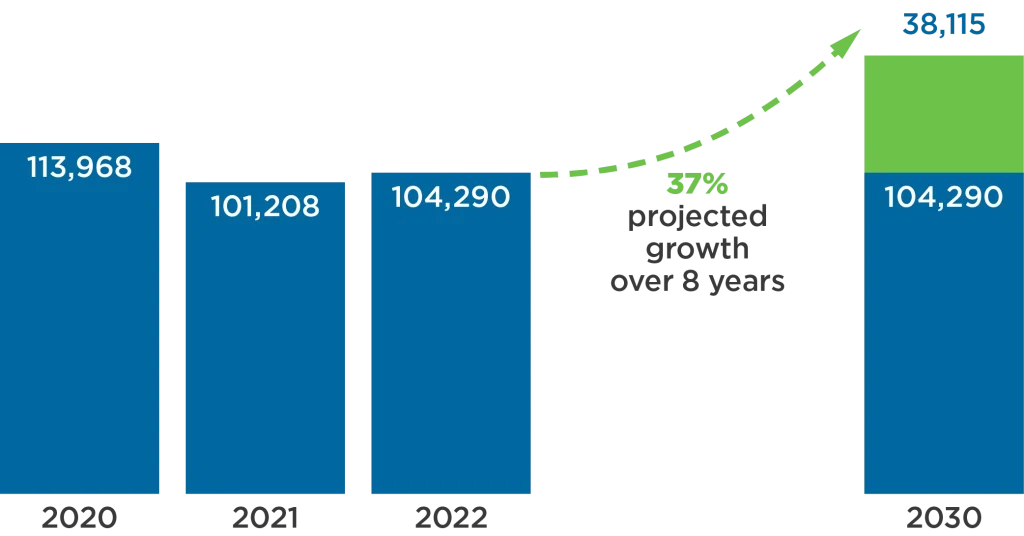

It is clear there is a pressing need for a robust and well-trained clean energy workforce in Massachusetts. Presently, the state boasts 108,450 direct clean energy jobs, which further supports an additional 104,325 direct or induced jobs. In July, MassCEC unveiled an expansive Workforce Needs Assessment detailing the roadmap for clean energy workforce growth. To meet climate milestones, we must add 38,000 more workers to the industry by 2030. Building upon our robust workforce development programming, we can meet these challenges and bring valuable and rewarding careers to Massachusetts residents.

MASSACHUSETTS CLEAN ENERGY INDUSTRY HIGHLIGHTS

2023

MASSACHUSETTS CLEAN ENERGY INDUSTRY HIGHLIGHTS1

Since 2010, the Massachusetts clean energy industry has experienced:

Sub-sectors that experienced the greatest rate of job growth between 2022 and 2023 reports 2

Building Materials

ECONOMIC CONTRIBUTION ANALYSIS

ECONOMIC CONTRIBUTION ANALYSIS

DECEMBER 2022

Based on this analysis, the

MASSACHUSETTS CLEAN ENERGY INDUSTRY

is responsible for a total economic contribution of:

MASSACHUSETTS IS A LEADER

MASSACHUSETTS IS A LEADER

In the Top Ranking

MASSACHUSETTS IS A LEADER

MASSCEC SPOTLIGHT

MassCEC’s Offshore Wind Leadership

MassCEC’s work has helped to address numerous challenges to growing the offshore wind industry, including:

MassCEC’s Offshore Wind Ports Challenge

MassCEC leveraged significant private and other public investments in specific maritime port rehabilitation and redevelopment activities to advance the offshore wind sector and capture high-value supply chain and workforce opportunities for the Commonwealth.

Broader Impacts

Initial Results

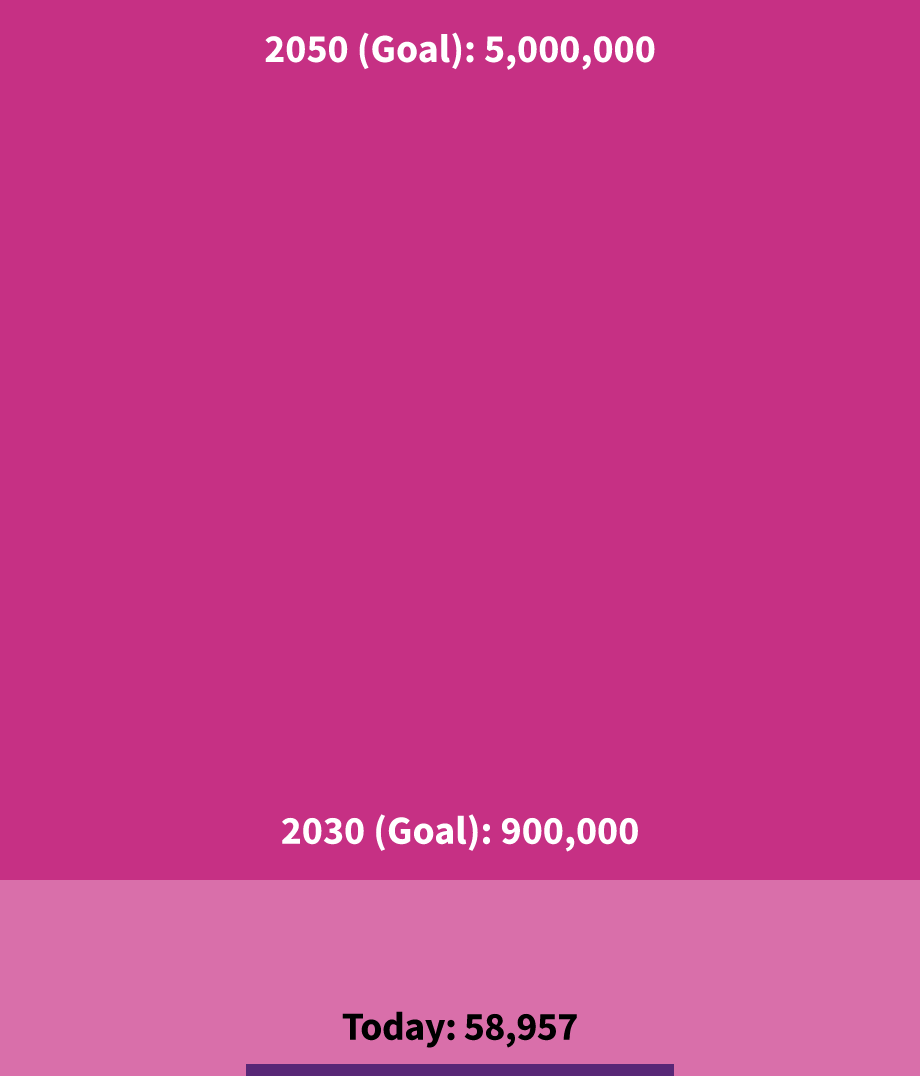

MASSACHUSETTS’ CLIMATE GOALS

Massachusetts’ Climate Goals

The Commonwealth has made progress in decarbonizing the electric grid, buildings, and vehicles, but more needs to be done to ensure the state meets its ambitious and critical goals.

CLEAN ENERGY JOBS AND BUSINESSES

TOTAL CLEAN ENERGY JOBS5

This report defines a clean energy worker as a person who spends some portion of their time working in renewable energy, energy efficiency, alternative transportation, or other carbon management technologies. In Massachusetts, 108,450 workers spend some portion of their time working in clean energy. Of those workers, 70% spend the “majority” or “all of their time” working in clean energy, compared to an average of 63% nationally.

REPORT YEARS 2010-20237

CLEAN ENERGY JOBS BY VALUE CHAIN8

JOBS BY VALUE CHAIN9

CLEAN ENERGY JOBS BY SECTOR8

The Renewable Energy sector grew by 3% and the Energy Efficiency, Demand Management, and Clean Heating and Cooling sector, which continues to have the largest number of absolute jobs, grew by 3%.

JOBS BY SECTOR9

JOBS BY SECTOR9

ENERGY EFFICIENCY, DEMAND MANAGEMENT, AND CLEAN HEATING AND COOLING JOBS10

CLEAN ENERGY JOBS AND BUSINESSES

MASSCEC SPOTLIGHT

DECARBONIZING MULTI-FAMILY BUILDINGS

MassCEC’s Passive House Design Challenge

Program Results

Broader Impacts

CLEAN ENERGY JOBS AND BUSINESSES

ALTERNATIVE TRANSPORTATION JOBS11

CLEAN ENERGY JOBS AND BUSINESSES

MASSCEC SPOTLIGHT

ACCELERATING CLEAN TRANSPORTATION

MassCEC developed the Accelerating Clean Transportation for All (ACT4All) Program to pilot equity‑focused transportation programs and increase access for disadvantaged communities across Massachusetts. One program was focused on increasing e-bike use in pilots across the state.

MassCEC’s ACT4ALL E-Bike Projects

Cape Light Compact

MASSBIKE

Metro Mobility

Pioneer Valley Planning Commission

CLEAN ENERGY JOBS AND BUSINESSES

RENEWABLE ENERGY JOBS12

Massachusetts’ solar industry grew by 3% (506 jobs), which is just slightly lower than the nationwide growth in solar jobs of 4%.

CLEAN ENERGY BUSINESSES

Small businesses (1 to 10 employees) account for 58% of all clean energy businesses, which is similar to the 2022 report. Mid-size businesses (11 to 49 employees) represent 27% of clean energy businesses.

GROSS STATE PRODUCT

CLEAN ENERGY GROSS STATE PRODUCT14

CLEAN ENERGY GROSS STATE PRODUCT BY VALUE CHAIN14

The Manufacturing sector continues to account for the largest contribution to clean energy GSP, at 24%, or $3.6 billion.

WORKFORCE NEEDS ASSESSMENT

MASSCEC SPOTLIGHT

MASSACHUSETTS CLEAN ENERGY WORKFORCE NEEDS ASSESSMENT

Major findings of the report:

Top Five Report Highlights and Recommendations

There are many approaches that can reduce barriers to entry into the clean energy industry for prospective workers. Among them, expanding access to accurate, engaging, and comprehensive information about clean energy career pathways is essential to driving career awareness, especially for underrepresented populations in the industry. Future investments in training capacity should focus on expanding access to training opportunities and enhancing outreach and support services. Efforts to engage clean energy businesses to deploy inclusive hiring practices and a welcoming and supportive work environment can support increasing worker retention and diversity in the industry.

Additionally, some persistent barriers, such as lack of reliable transportation, will require a whole government approach to effectively address.

BARRIERS TO ENTRY INTO CLEAN ENERGY BY RACE AND ETHNICITY17

CLEAN ENERGY TALENT

CLEAN ENERGY TALENT IS NEEDED

According to surveyed employers, approximately 71% of clean energy workers who were hired between December 2021 and December 2022 filled positions that required previous work experience. About 59% of these job hires filled newly created positions. The education credential requirements for the filled positions ranged, but almost half (49%) required a bachelor’s degree or higher. Alternatively, according to a recent MassCEC report, between now and 2030, clean energy employers will require a range of new workers across 140+ occupations, many of which will require less than a 4-year degree for entry.18

REASONS FOR HIRING CHALLENGES

CLEAN ENERGY TALENT

MASSCEC SPOTLIGHT

BUILDING THE CLEAN ENERGY WORKFORCE PIPELINE

MassCEC’s Clean Energy Internship Program

Program Results

Broader Impacts

Collaborating to Expand Clean Energy Career Awareness

Broader Impacts

CLEAN ENERGY TALENT

CLEAN ENERGY WORKER DEMOGRAPHICS20

The state is committed to supporting individuals in environmental justice neighborhoods and disadvantaged populations to get the education and training needed to access high-paying occupations in clean energy and enabling minority and women-owned business enterprises to access the resources needed to pivot and grow as employers in the clean energy industry.

CLEAN ENERGY WAGES

DIVERSITY CONSIDERATIONS

Employers utilize a variety of methods to increase diversity among workers, with targeting schools or conducting outreach being the most common strategy.

EMPLOYER SUPPORT PROGRAMS

Increasing registered apprenticeships is important, as it is a proven model for improving access to careers and is supported financially at the state and federal level.23

SPONSORSHIP PROGRAM REPORT YEAR 2023

CLEAN ENERGY TALENT

MASSCEC SPOTLIGHT

INCREASING EQUITY IN THE CLEAN ENERGY INDUSTRY

MassCEC Equity Workforce Planning, Capacity, and Implementation Grant Program

Initial Program Highlights

Broader Impacts

CLEAN ENERGY INVESTMENTS AND INNOVATION

CLEAN ENERGY INVESTMENTS

Investments in clean energy companies can fall into three key segments24:

Stage II: Demonstration & Acceleration – Companies at the product testing, system evaluation, and market research stage.

Stage III: Commercialization & Growth – Companies that are expanding manufacturing capacity and identifying early-stage customers.

TOTAL MASSACHUSETTS CLEAN ENERGY DEALS24,25

TOTAL MASSACHUSETTS CLEAN ENERGY INVESTMENTS (millions)25, 26

CLEAN ENERGY INVESTMENTS AND INNOVATION

MASSCEC SPOTLIGHT

MASSCEC INVESTMENTS PORTFOLIO

MassCEC’s clean energy company investments have yielded

MASSCEC SUPPORT FOR INNOVATION

MassCEC provides funding and mentorship to Climatetech startups, researchers, incubators, and accelerators.

Since 2010 MassCEC’s Technology Development and Innovation Program has facilitated:

REGIONAL ANALYSIS

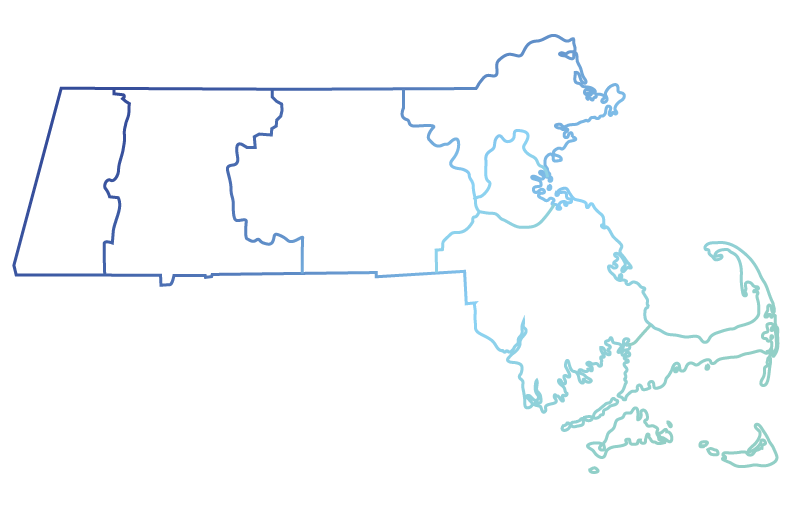

REGIONAL ANALYSIS

Clean Energy Jobs And Businesses In Massachusetts Workforce Skills Cabinet Regions

Businesses

Businesses

Businesses

Businesses

Businesses

Businesses

Businesses

214

444

1,254

2,199

709

727

1,609

229

456

1,274

2,242

718

748

1,648

Report Change

7.0%

2.7%

1.6%

2.0%

1.3%

2.9%

2.4%

Clean Energy Jobs/

Businesses in 2023

3.1%

6.2%

17.4%

30.6%

9.8%

10.2%

22.5%

Jobs/Businesses

in Region

4.0%

3.5%

4.4%

2.1%

1.9%

2.6%

3.4%

Businesses

Businesses

Businesses

Businesses

Businesses

Businesses

Businesses

214

444

1,254

2,199

709

727

1,609

Businesses

Businesses

Businesses

Businesses

Businesses

Businesses

Businesses

229

456

1,274

2,242

718

748

1,648

Businesses

Businesses

Businesses

Businesses

Businesses

Businesses

Businesses

Report Change

7.0%

2.7%

1.6%

2.0%

1.3%

2.9%

2.4%

Businesses

Businesses

Businesses

Businesses

Businesses

Businesses

Businesses

Clean Energy Jobs/

Businesses in 2023

3.1%

6.2%

17.4%

30.6%

9.8%

10.2%

22.5%

Businesses

Businesses

Businesses

Businesses

Businesses

Businesses

Businesses

Jobs/Businesses

in Region

4.0%

3.5%

4.4%

2.1%

1.9%

2.6%

3.4%

STATE-BY-STATE COMPARISON

STATE CLEAN ENERGY JOB RANKINGS, REPORT YEAR 202328

TOTAL STATE CLEAN ENERGY JOBS

TOTAL CLEAN ENERGY JOBS PER CAPITA

TOTAL CLEAN ENERGY JOBS AS A PERCENTAGE OF TOTAL STATE EMPLOYMENT

STATE CLEAN ENERGY JOB RANKINGS, REPORT YEAR 2023

METHODOLOGY

METHODOLOGY

The 2023 USEER survey in Massachusetts was administered by telephone, with approximately 29,400 outbound calls in Massachusetts, as well as by web, with more than 12,600 emails sent to potential participants across the state.

In total, 1,147 business establishments in Massachusetts participated in the survey effort, with 402 providing full responses to the survey. These responses were used to develop incidence rates among industries as well as to apportion employment across various industry categories in ways currently not provided by state and federal labor market information agencies. The margin of error is +/- 4.87 percent at a 95 percent confidence level. See the full Expanded Methodology for more details on the 2023 Massachusetts Clean Energy Industry Report.